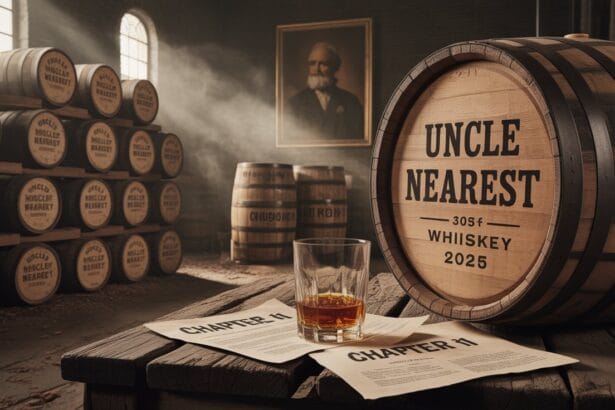

The Uncle Nearest Chapter 11 filing has sent shockwaves through the spirits world. Once celebrated as a success story for diversity and legacy in American whiskey, the brand is now facing deep financial trouble. The Uncle Nearest bankruptcy marks one of the most talked-about moments in what many are calling the whiskey industry downturn 2025.

This event is not just a corporate failure — it reflects the harsh economic climate gripping the entire whiskey sector.

The Fall of a Celebrated Brand

Uncle Nearest was more than just another bourbon label. It carried a proud heritage tied to the story of Nearest Green, the first known African-American master distiller in U.S. history. The company built its brand around a powerful message of inclusion and history. For years, it symbolized how culture and craftsmanship could thrive together.

However, despite its strong identity and loyal following, the company’s financial foundation began to crack. High expansion costs, rising interest rates, and changing consumer spending habits created the perfect storm. In mid-2025, the company finally sought protection under Uncle Nearest Chapter 11, confirming what industry insiders had feared for months — the business was running out of cash.

What the Uncle Nearest Bankruptcy Means

The Uncle Nearest bankruptcy filing has opened a window into the struggles of the modern spirits industry. The brand reportedly defaulted on massive loans and faced pressure from creditors. Court documents show that the company sought reorganization to preserve operations while restructuring its debts.

While Chapter 11 allows a business to continue trading, it also signals a critical point. For Uncle Nearest, this move might mean losing ownership control or selling parts of its assets. The brand’s once-bright future is now tied to how the restructuring unfolds.

The bankruptcy has also sparked emotional responses across the whiskey community. For many, Uncle Nearest represented a new chapter in a 159-year-old whiskey legacy — one that linked heritage, craftsmanship, and progress. Its collapse feels like a setback for inclusivity and recognition in a field long dominated by larger, traditional distilleries.

Not Alone in Trouble: A Wave of Chapter 11 Filings

The situation at Uncle Nearest is not isolated. Other long-standing distilleries have also faced major challenges this year, showing that the whiskey industry downturn 2025 is real and widespread.

Two more names have recently joined the list:

- Staggemeyer Stave Chapter 11: This Kentucky-based barrel-making company, known for supplying premium oak casks, filed for Chapter 11 bankruptcy in early 2025. The company cited rising material costs and declining orders from whiskey producers as key reasons for its collapse.

- Boston Harbor Distillery Chapter 11: Once a popular craft whiskey and rum producer, Boston Harbor Distillery also entered bankruptcy protection this year. The brand’s financial reports showed a steep fall in revenue due to oversupply and reduced consumer spending on premium spirits.

Together, these cases reflect a broader crisis. Production costs have increased, exports have slowed, and consumer demand has shifted toward ready-to-drink options and cheaper alternatives. Even historic and craft distilleries with loyal fans are struggling to survive.

The Whiskey Industry Downturn 2025: What Caused It

Several key factors have contributed to the whiskey industry downturn 2025:

- Rising costs: Grain, glass, and logistics prices have climbed sharply.

- Market saturation: Too many new brands flooded the market over the past five years.

- Interest rates: Higher borrowing costs have made expansion nearly impossible.

- Changing tastes: Younger consumers are switching to canned cocktails, hard seltzers, and low-alcohol options.

- Global slowdown: Exports to Europe and Asia have declined due to currency shifts and trade pressures.

The combined effect has hit small and mid-sized distilleries the hardest. Those that grew fast — like Uncle Nearest — are now paying the price for rapid scaling in an unstable economy.

A Legacy on the Line

Beyond numbers, the biggest concern is the cultural loss. The Uncle Nearest bankruptcy could erase decades of work celebrating the roots of American whiskey. The brand was built to honor Nearest Green’s story — a man who helped shape the techniques that defined Tennessee whiskey over a century ago.

This story is part of a 159-year-old whiskey legacy that began before modern bourbon even took shape. The company’s success once inspired new Black-owned spirits brands to enter the market. Now, its struggle serves as a warning of how fragile even the most meaningful ventures can be when faced with financial and market realities.

If the Chapter 11 process fails to save the company, the industry could lose not only a major brand but also an important part of its shared heritage.

Lessons and Outlook

The wave of bankruptcies — from Uncle Nearest Chapter 11 to Staggemeyer Stave Chapter 11 and Boston Harbor Distillery Chapter 11 — has forced the whiskey world to rethink its future. Sustainability, financial discipline, and brand authenticity will now matter more than ever.

Still, experts believe that the spirit of resilience remains. The heritage behind these brands continues to inspire both distillers and drinkers. If Uncle Nearest can successfully emerge from reorganization, it could once again stand as a symbol of endurance in the face of adversity.

The next few months will determine whether this iconic name can rebuild or become another casualty of the whiskey industry downturn 2025.